PV Sales Drop Amid Festive Season Challenges. Dealer inventory levels of passenger vehicles have reached a critical point, with a total value of Rs 77,800 crore.

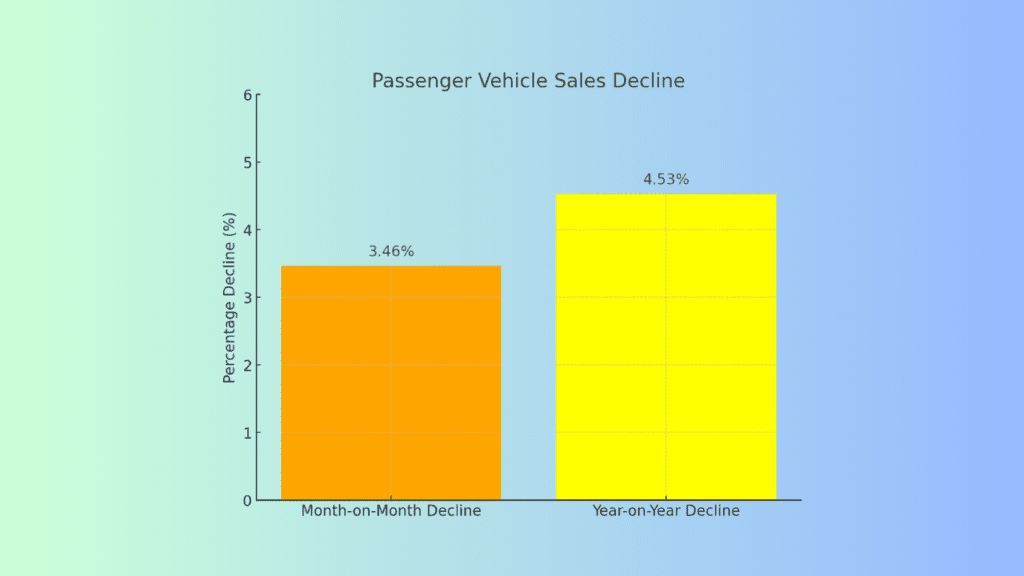

The Federation of Automobile Dealers Associations (FADA) has raised alarms over the state of the passenger vehicle (PV) market, reporting a 3.46% month-on-month (MoM) decline and a 4.53% year-on-year (YoY) drop in sales. Despite the arrival of the festive season, the market is under pressure due to delayed customer purchases, poor consumer sentiment, and persistent heavy rains. Inventory levels have reached critical proportions, with stock days extending to 70-75 days, and total inventory climbing to 7.8 lakh vehicles, valued at Rs.77,800 crore. FADA Warns Auto Industry Crisis.

FADA Warns of Auto Industry Crisis

Instead of addressing the situation, PV Original Equipment Manufacturers (OEMs) continue to increase dispatches to dealers on a MoM basis, further worsening the inventory issue. This unchecked supply strategy threatens to escalate the crisis if not adjusted immediately.

FADA Calls for Urgent Intervention by Banks and NBFCs

FADA is calling on banks and Non-Banking Financial Companies (NBFCs) to intervene by restricting funding to dealers who are already burdened with excessive inventory. Dealers must also take swift action to stop accepting additional stock to safeguard their financial health. Without immediate adjustments, the industry may face significant disruption.

Commercial Vehicle Segment Also Suffers Sharp Decline

The commercial vehicle (CV) market has not been spared, with sales plummeting by 8.5% MoM and 6.05% YoY. Key factors contributing to the decline include severe weather conditions such as heavy rains, floods, and landslides, which have hindered market activity. Reduced construction activity and weak demand in industrial sectors have further aggravated the situation.

Pressure Mounts on CV Segment Amid Competition and Discounts

The CV segment is facing heightened competition, with steep discounting by competitors intensifying the decline. Coupled with ongoing inventory and cash flow challenges, the weak market sentiment continues to weigh heavily on the industry. FADA warns that if the aggressive push of excess stock continues unchecked, the entire auto retail ecosystem could face severe disruption.