It’s worth noting that a significant portion of the income tax returns submitted for the fiscal year 2022-23 showed no tax liability. This accounted for nearly 70% of all filings.

For most categories of taxpayers, July 31, 2023, was the deadline for filing an income tax return (ITR) for the assessment year 2023-24 (financial year 2022-23). The Ministry of Finance reported that the total number of ITRs filed for this period was over 6.77 crore, which is 16.1% higher than the 5.83 crore ITRs filed for the previous year as of the same day in 2022.

Zero-tax liability

7.4 crore people filed IT Returns in 2022-23, but 70% claimed zero-tax liability

According to information provided by the Lok Sabha, there has been an increase in the number of people filing income tax returns from 6.48 crores to 7.4 crores between 2019-20 and 2022-23. Additionally, the number of people filing returns with zero tax liability has risen from 2.9 crores in 2019-20 to 5.16 crores in 2022-23. To provide context, the number of those who filed ITRs increased by 14.2%, while the number of people with zero tax liability increased by 63%.

The percentage of individuals claiming zero-tax liability skyrocketed from 45% in 2019-20 to a whopping 70% in 2022-23. Out of the 7.4 crore individuals who filed ITR, a staggering 5.16 crore claimed zero tax liability in 2022-23. This means that only 2.24 crore individuals paid income tax in 2022-23, compared to the 3.58 crore who paid income tax in 2019-20. The reasons behind this dramatic difference in numbers remain unclear at this time.

Only 1.6% of India’s population paid income tax

The percentage of people filing income tax returns in India has remained low. In 2022-23, only 1.6% of the population paid income tax, compared to 2.15% in 2019-20. The number of people filing zero tax returns increased from 2.15% to 3.72% during the same period.

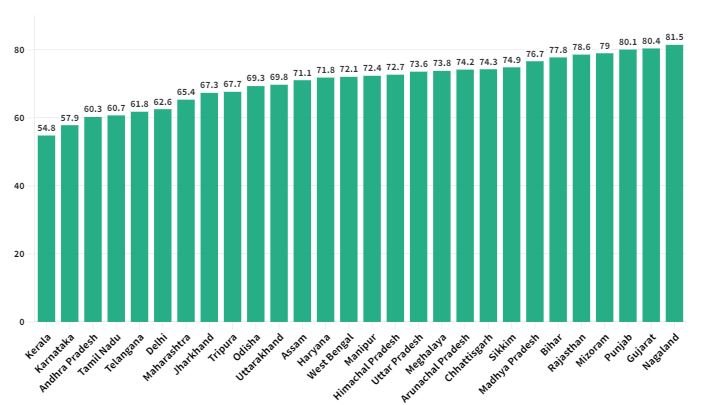

80% claimed zero tax liability in Gujarat

More than 80% claimed zero tax liability in Nagaland, Gujarat, and Punjab in 2022-23

Among those who filed ITR, the share of people claiming zero tax liability was more than 80% in Nagaland, Gujarat, and Punjab in 2022-23. The share has been above 70% across almost all the Northeastern States in the last three years. This may be attributed to certain exemptions extended to people in these states in the income tax act as 30% of the population of this area are scheduled tribes.

The South Indian states have a smaller percentage of individuals with zero tax liability in their Income Tax Return (ITR). As of 2022-23, Kerala had the lowest percentage among the states, with only 54% of individuals who filed their ITR having zero tax liability. Karnataka had 57%, while Andhra Pradesh and Tamil Nadu had around 60%. Telangana had the highest percentage at 61.8%.

About 22% filed ITR in Chandigarh, and Less than 2% in Bihar

Only Chandigarh has consistently reported around 22% of the population filing ITR. About 17% of the population in Delhi and 14% in Goa filed ITR each year. While the share has increased across most states, in Punjab, the share increased from 10.2% to 11.75% and in Gujarat, the share increased from 9.4% to 10.4% in four years.

Odisha reported less than 3% people filed ITR

Despite having major cities attracting employment, the share of people filing ITR in Maharashtra, Karnataka, Telangana, and Tamil Nadu was between 5 to 10% throughout while it was around 4% in West Bengal. This can also be read as more than 90% did not even file ITR in these states. Excluding Northeastern states, Bihar consistently reported less than 2% while Odisha reported less than 3%.