India has emerged as a global leader in cryptocurrency adoption for the second consecutive year, according to a recent report by blockchain analytics firm Chainalysis. This development comes despite India’s stringent regulatory environment and high trading taxes. The report highlights India’s increasing participation in both centralized and decentralized financial assets from June 2023 to July 2024.

India Surpasses Crypto Adoption Despite Regulations

Since 2018, India has maintained a tough stance on cryptocurrencies, taking multiple steps to curb their growth. In December 2023, the Financial Intelligence Unit (FIU) issued show-cause notices to nine offshore crypto exchanges for failing to comply with local regulations. However, these restrictions haven’t deterred Indian investors from participating in the market.

Eric Jardine, research lead at Chainalysis, stated, “India has shown a broad-based adoption of different crypto assets, even under restrictions.” This indicates that many new users have found alternative ways to access crypto through platforms not subject to bans. reportsrecords.com

Regulatory Changes Signal Increased Adoption

Recent changes in the regulatory landscape have started to ease the crypto restrictions in India. Binance, the world’s largest cryptocurrency exchange, faced a fine of 188.2 million rupees ($2.25 million) in June but registered with the FIU in a move to resume operations in the country. Similarly, KuCoin, another major exchange, registered with the watchdog in March 2024 and was fined a smaller amount of 3.45 million rupees.

These developments suggest that as regulations begin to soften, cryptocurrency adoption in India is likely to increase further, particularly among new investors.

Asia Dominates Crypto Adoption

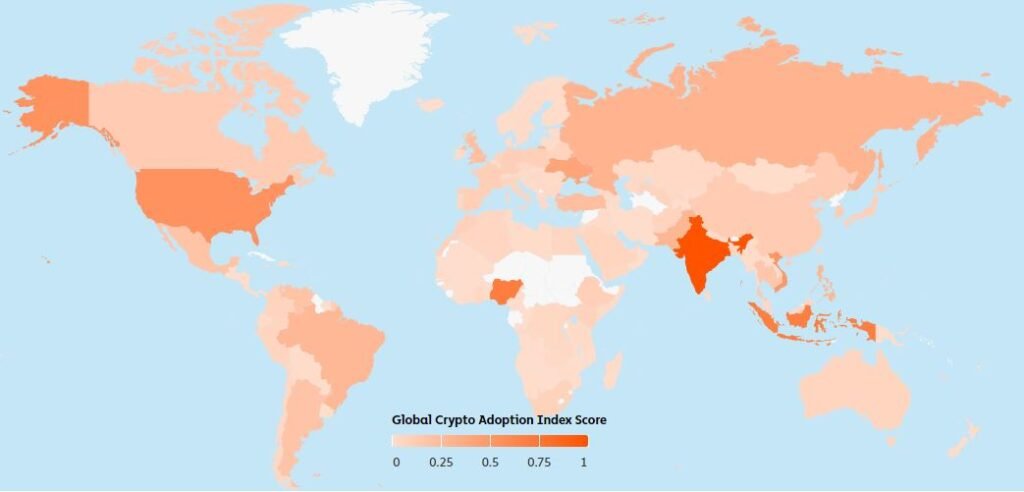

India is not alone in leading the global crypto adoption trend. According to the Chainalysis report, seven out of the top 20 countries in the global adoption index are in Central and South Asia. Indonesia, Vietnam, and the Philippines have all witnessed significant growth in cryptocurrency trading.

In Indonesia, where the use of cryptocurrencies as a payment method is banned but investment in digital assets is allowed, trading has remained strong. The country recorded $157.1 billion in digital asset inflows from July 2023 to July 2024.

Crypto Adoption Strong in Lower-Income Countries

The report also revealed that countries with lower purchasing power per capita saw a higher volume of decentralized crypto transactions, particularly in retail-sized transfers of under $10,000. This trend suggests that in countries with limited economic opportunities, people are increasingly turning to cryptocurrency as an investment and alternative financial tool.